Laura and Craig made initial contact with us in early 2018, after being referred by long-standing friends who were already clients. They had recently retired, after having worked in the public sector, and were both now in receipt of their final salary pensions. Both were in good health, generally, although Craig suffers from asthma. They had accumulated savings throughout their working lives, as well as an inheritance, and this was invested in a portfolio set up by another established financial advisory firm. Laura and Craig approached us for advice because they were concerned about how their investment portfolio was being managed. With limited investment knowledge and expertise, they were keen to get a second opinion.

One of our Chartered Financial Planners met with Laura and Craig. This exploratory meeting gave the three of them a good chance to sit down and discuss Laura and Craig’s situation in more detail. Our adviser was able to spend time learning about their lifestyle and financial goals, before explaining the process of becoming a client of Mearns & Company. Between them, they had identified and prioritised the following objectives:

After we reviewed Laura and Craig’s investment portfolio, we established that their investment portfolio wasn’t suitable for the following reasons:

We carried out analysis to recommend a new, more appropriate financial planning strategy for Laura and Craig. The first step was to ensure that they had a strong cash position, meeting the cost of any unforeseen expenditure by having a suitable emergency fund in place and also holding enough cash to cover planned capital expenditure within the next five years. The second step was to recommend a bespoke investment strategy that was well-diversified and appropriate for their balanced attitude to risk and specific ethical investment preferences.

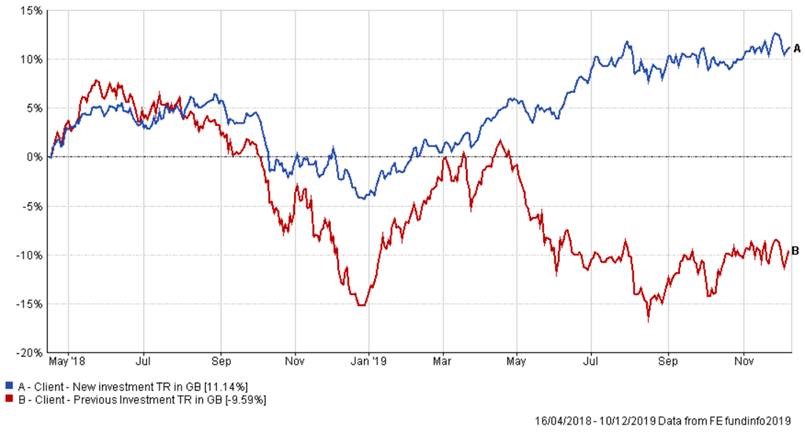

Laura and Craig now feel in a much more secure financial position. Their new investment portfolio has significantly outperformed their previous portfolio since the change in strategy, as shown:

Please note that this graph represents a snapshot in time and there is no guarantee that the returns achieved will be replicated in the future.

Not only have Laura and Craig benefited from relative out performance of 20.84%, as at 10th December 2019, but they are now investing in line with their ethical preferences with improved management and lower ongoing charges.

Hindsight is a wonderful thing, of course. The investment fund in which Laura and Craig were previously invested has since suspended trading and is being wound up with no access for investors in the meantime. The final loss for investors in the suspended fund will almost certainly be significant. The impact of this for Laura and Craig would have been devastating.

Having flexible access to their investment portfolio is key for their goal of achieving their “desired lifestyle in retirement by providing for the cost of holidays”. They have since decided to take longer holidays in warmer climates, not just to enjoy some sun, but, because it significantly improves Craig’s asthma and his overall wellbeing. We have encouraged Laura and Craig to access their investment portfolio in the future, if required, to cover the cost of these holidays, which they currently wouldn’t have been able to do had the previous strategy remained in place.

Names and other details that could potentially identify our clients have been changed to protect their privacy.