Managing the new pension allowance landscape

Post by Mearns & Company in News

Your retirement planning options could need review after the Budget changes to the lifetime allowance and the annual allowance.

When the current pension tax regime was introduced 17 years ago, two new constraints were key to its structure:

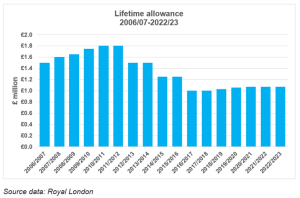

- The lifetime allowance set the effective maximum tax efficient value of your retirement benefits. It started at £1.5 million, which in today’s money is about £2.44 million.

- The annual allowance set your maximum tax-relievable contribution from all sources across a single tax year. It began at £215,000 in 2006/07.

Initially both allowances increased every new tax year, but as the Treasury grew concerned about the cost it began a whittling down process that meant by 2022/23 the lifetime allowance was £1.0731 million and the annual allowance £40,000 (at best). While the cuts to both allowances saved money for the Exchequer, they also created difficulties for higher earners, some of whom found that pension contributions had become tax inefficient.

The March 2023 Budget made two important announcements on the allowances:

- The lifetime allowance will disappear completely from 2024/25, while in 2023/24 it will generally not apply to retirement benefits.

- The maximum annual allowance was raised from £40,000 to £60,000 from 2023/24.

Some annual allowance increase had been expected because of the problems it was causing to NHS consultants and doctors, but the lifetime allowance abolition was a surprise move. Taken together, the Budget changes mean that you now have greater scope to plan your retirement using pension arrangements rather than other forms of saving.

That is particularly the case if you (and your employer) were prevented from making any pension contributions because of either the risk of exceeding the then lifetime allowance, or if you benefitted from one of the various transitional lifetime allowance protections introduced over the years.

Planning considerations

Whether or not the lifetime allowance has been a consideration for you in the past, you or your employer can now make a pension contribution without worrying about lifetime allowance constraints. Those contributions could cover not only the current tax year, but also any unused annual allowance from the last three tax years – a maximum potential total contribution of £180,000 in 2023/24.

In practice any resumption of, or increase to, contributions should only happen after a careful review of your personal circumstances and retirement options. For example:

- If you have already taken income flexibly from a defined contribution pension, your total contributions will be subject to the money purchase annual allowance of £10,000 per tax year (an increase from the previous £4,000).

- Making a large contribution in one tax year may mean you receive less tax relief than you would by spreading the contribution over several tax years. Do not forget that in 2023/24 additional rate tax (top rate in Scotland) starts at £125,140.

- If you are self-employed and subject to the basis year transitional rules in 2023/24, a substantial one-off contribution could help counter the increased income tax bill you may face.

- New rules that place a cash ceiling on the 25% tax-free pension commencement lump sum could mean that all or part of any fresh contributions can only be used to provide taxable pension income. In that instance, you may prefer other investment options.

Even if you do not want to add to your retirement fund, pension contributions may still make sense from an estate planning viewpoint. Death benefits from pension arrangements are generally free of inheritance tax, and on death before age 75 also income-tax free for the recipients.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate will writing and some forms of estate planning.

Occupational pension schemes are regulated by The Pensions Regulator